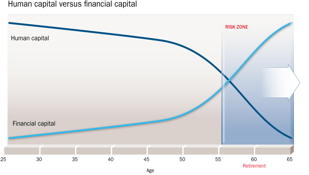

Understanding the dynamics of human and financial capital will help you select right product solutions to mitigate the market risks every investor faces. This knowledge also will help you get the most out of your financial security plan.

When you’re younger, you have lots of human capital. In other words, you still have many years ahead to work and grow your savings – or financial capital.

At this point your financial capital usually is low. This means you generally can accept more risk because your time horizon is long – you have years to grow your wealth, and recover from market downturns. Knowing this allows you to adopt an aggressive investment strategy.

Unfortunately, many clients at this stage of life are not active in the investment market. Some remain nervous after the recent recession. However, sitting on the sidelines and waiting isn’t an effective strategy for building financial capital. In fact, it can actually create a different risk − the risk you won’t achieve your long-term financial goals.

In these cases it’s important you consult with me. I can explain various investment products that will help mitigate your risks and get you on the path to achieving your financial goals. Most important, I can tell you if these products are right for your individual situation.

The scales shift in later years

As you near retirement, your human capital declines. This is when market risks are more threatening because you have less time to recover losses. And this is often when you have the most to lose -- after growing your financial capital over the year. At this point, you’ll want to ensure your portfolio is protected against market risks and available to create a future income stream. Again, I can help you do this through a comprehensive, fully-integrated approach to financial security planning.

The information provided is based on current tax legislation and interpretations for Canadian residents and is accurate to the best of our knowledge as of the date of publication. Future changes to tax legislation and interpretations may affect this information. This information is general in nature, and is not intended to be legal or tax advice. For specific situations, you should consult the appropriate legal, accounting or tax advisor.