Five financial steps for new parents

Becoming a parent is filled with new joys, challenges and financial goals. While personal finances may not be on your mind, here are five things to consider when bringing your bundle of joy home for the first time.

- A social insurance number (SIN) To claim children as dependants or set up savings accounts in their name, they must have a social insurance number. Most provinces offer a Newborn Registration Service that allows you to apply for a SIN. In British Columbia and Ontario, you can apply for their birth certificate at the same time.

- Baby comes first – but don’t forget about your other financial goals Food, childcare and education costs are just some of the expenses you’ll need to add to your budget. New parents often prioritize those costs over their own financial goals, such as saving for a home, vehicle or vacation. Remember to pay yourself first and benefit from the power of compounding interest (making interest on your already-earned interest) to increase your savings.

- Start saving for post-secondary education With the average full-time Canadian undergraduate student paying annual tuition fees of nearly $6,0001, post-secondary education can be an overwhelming expense. A registered education savings plan (RESP) can help get you closer to that goal. Not only does the money grow tax-free within the plan, but the government chips in with substantial grants.

- Plan to protect your family’s financial security if the unexpected happens You need to help ensure your family will be taken care of financially you die or your partner dies unexpectedly. Once you’ve calculated how much you’ll need to pay off your mortgage, help put your child through postsecondary school, and replace your lost income, you can approximate how much life insurance you may need. Also, consider these basic estate planning steps for new parents:

-Create an inventory of assets and debts and store it in a safe place that only a trusted person can access

-Review your insurance policies and update beneficiaries if any changes are needed

-Prepare a will and identify the person you would request to be the child’s guardian - Budgeting for baby When infants first come home, their needs may be basic. But as they grow, previously unconsidered expenses – such as increased health insurance premiums – can surprise parents. It’s important to start your budget now. Set up a category just for your child and log all childcare expenses under it to see how much you’re spending.

Getting your finances in order is a great way to manage the challenges of being a new parent.

1Statistics Canada, University tuition fees, 2014/2015, http://www.statcan.gc.ca/daily-quotidien/140911/dq140911b-eng.htm

10 questions to consider for your retirement

- When do you want to retire? The timing of your retirement is crucial to building your retirement nest egg and assessing how long it needs to last. In retirement, you will experience a fundamental shift – from saving to spending.

- How much of your current income do you expect to need in retirement? Your goals and challenges are unique to your life situation. The amount of your current income you’ll need in retirement depends on how much you’ve saved and how much you plan to spend during retirement.

- How do you plan to spend your money? How you spend during your retirement will depend on your choices and could be influenced by factors beyond your control.

- Have you considered your retirement lifestyle needs? What is your lifestyle vision for your retirement years? How will you spend your time? These choices may impact your spending pattern during retirement.

- What guaranteed sources of income can you count on in retirement? Taking into account your existing sources of guaranteed income can help determine how much additional money you require to cover basic living costs and preserve the lifestyle you’ve worked hard to achieve. You’ve saved, invested wisely and built a sizeable nest egg. Retirement is within your grasp, so it is no time to take chances. Here are 10 questions to move you towards a secure, confident retirement.

- Do you plan to work part-time or full-time in retirement? Perhaps you want to continue using your skills or explore new opportunities. You could also be influenced by debts or helping family members.

- How do health and wellness factor into your retirement plan? Focusing on your wellness is central to your vitality and enjoyment of life. You may want to consider using retirement to focus on your mental and physical fitness. It’s important to make room in your budget for health and wellness priorities.

- Are you ready for the unexpected events in life? When considering retirement planning, take into account unpredictable events – both financial and personal – for which you want to be prepared. Check to see if your retirement nest egg is strong enough to support you through a future economic downturn, a rise in the cost of living or a longer lifespan.

- How will you keep your money working in retirement? In addition to fully protecting the money you need to cover your basic expenses, many retirees want a portion of their nest egg to grow.

- Do you plan to leave a legacy? You might want to leave an inheritance to your family or favourite charity.

Retirement brings many mixed emotions, but your financial security advisor can help you create a vision for the future so you can plan for retirement with confidence.

Don’t let your mortgage jeopardize your family’s financial security

You’re finalizing your mortgage – a huge commitment that comes with a great deal of responsibility. It’s natural to be concerned that your family might lose their home if the income earner was no longer around to make the payments.

You have a couple of options, both involving affordable monthly payments. Lending institutions offer mortgage insurance – also called creditor insurance — at the time you sign the mortgage. The other route is personal life insurance that you can buy through your financial security advisor.

Mortgage insurance is convenient. You can apply for insurance coverage at the same time you’re getting your mortgage. This insurance is used to cover the outstanding mortgage balance if you die. You can also include your spouse in the coverage.

However, it’s important to research the differences between mortgage insurance and personal life insurance to help ensure you’re giving yourself and your family the insurance protection that meets your needs.

You do have to qualify for personal life insurance, a process that may include verification that you and your spouse are in good health. Once you start paying the premiums, you’re covered for the term of the policy, with automatic renewals. And as long as premiums are paid as required, only you can cancel the policy.

The benefit payout

With mortgage insurance, your creditor is the named beneficiary and the proceeds are paid to the creditor, not your family. If you die or your spouse dies, the outstanding amount is paid off. As the mortgage is paid down the benefit coverage decreases.

Personal life insurance allows you to choose your beneficiaries. And the lump-sum benefit payment is paid tax free on the death of the life insured even if the mortgage is paid off. This type of coverage provides added financial security beyond just the mortgage.

Monthly premiums

With mortgage insurance, the coverage decreases each month until the entire principal is paid off, although the premiums stay the same. With personal life insurance, your coverage doesn’t decrease as the mortgage is paid

Don’t let your mortgage jeopardize your family’s financial security down and you can choose a plan that will keep the premium you pay level for 10 years, 20 years or for your lifetime.

Flexibility

Generally, most lending institutions offer non-convertible term life insurance where the lending institution owns the mortgage insurance policy. If you switch mortgage lenders, your policy is void. Given that you’ll be older than when you originally signed your mortgage or your health may have changed, the premiums with a new lender could be higher or you may not qualify for new coverage.

If you already have a personal life insurance policy in place and you buy a bigger home, you may want to consider increasing the coverage. One option may be to leave the existing policy in place and take out a second one to increase overall coverage for your family.

Take to time carefully weigh both options. A financial security advisor can provide expert guidance.

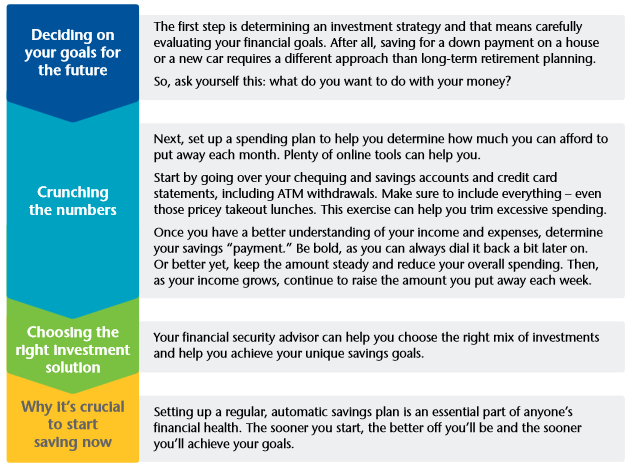

Good saving habits can lead to financial independence

Regardless of what you’re saving for – a down payment on a home, a dream vacation, a child’s education or your eventual retirement – developing good saving habits can definitely pay off. Even relatively small but regular contributions can quickly gain momentum thanks to the power of compounding, or making interest on your interest. Most people can rationalize buying new bedroom furniture or a better and more reliable car by using small monthly payments spread over several years. However, you can also use this strategy to build hefty savings. For some, saving is instinctive. Chipmunks know they must save enough nuts and seeds to get them through the winter. They even build storage rooms in their burrows. But it’s important everyone – even humans – realize the importance of saving.

The information provided is based on current tax legislation and interpretations for Canadian residents and is accurate to the best of our knowledge as of the date of publication. Future changes to tax legislation and interpretations may affect this information. This information is general in nature, and is not intended to be legal or tax advice. For specific situations, you should consult the appropriate legal, accounting or tax advisor.